EV Depreciation

The EV Depreciation Dilemma: What’s Going On with Electric Vehicle Resale Values?

The world of electric vehicles (EVs) is evolving rapidly — and not always in straightforward ways. For someone with your auto-appraisal background in Alberta, keeping tabs on how EVs are holding their value offers a strong vantage point. Here’s a deep dive into recent automotive news and data on EV depreciation, especially in Canada, with actionable take-aways you can use in your industry role.

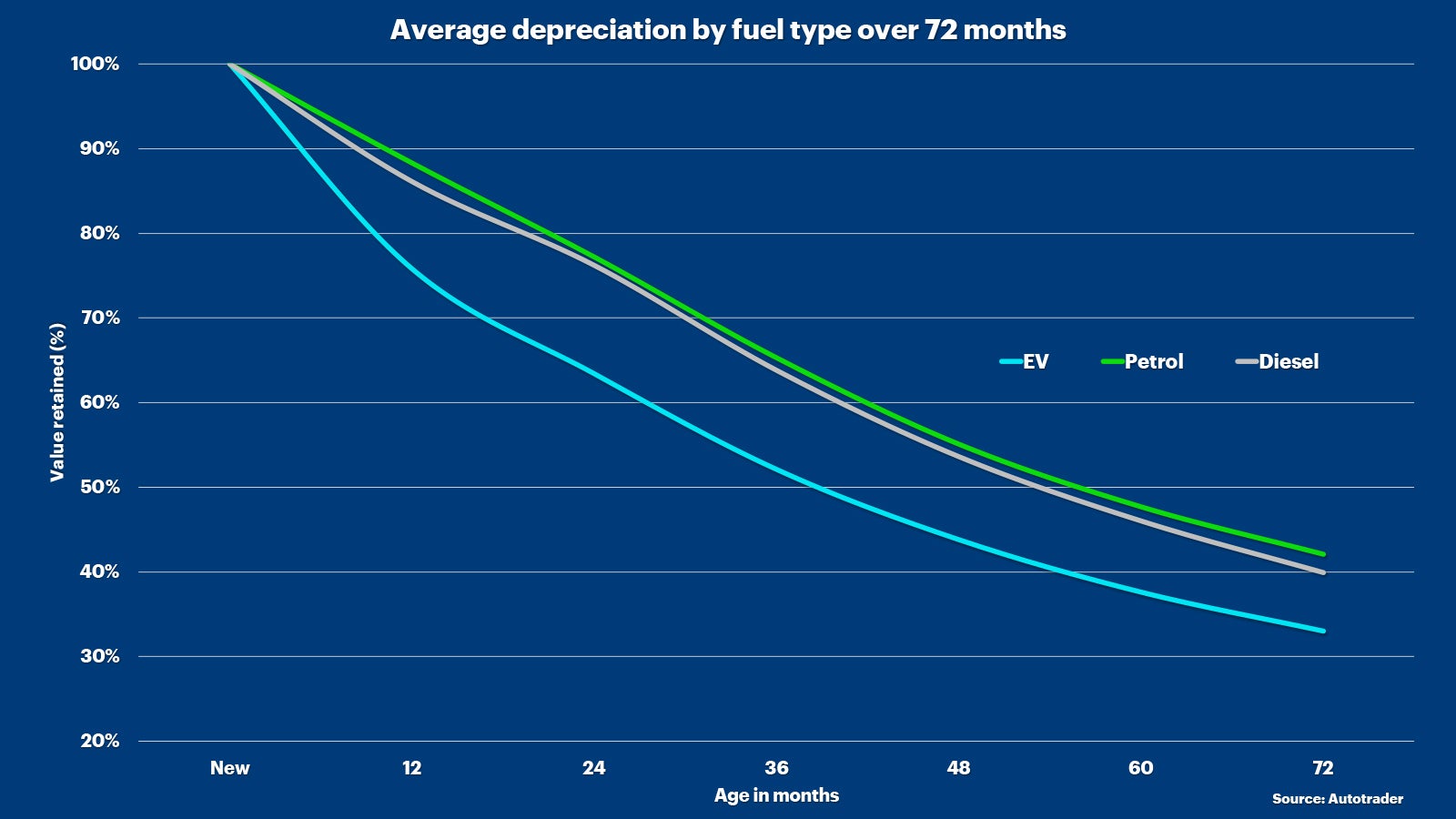

1. The Big Picture: EV Depreciation is Outpacing the Rest of the Market

The most striking headline: according to a study by iSeeCars, EVs depreciated by 58.8 % on average over five years, compared to 45.6 % for all vehicle types. (Motor Illustrated)

This means that, broadly speaking, if someone buys a new EV and drives it for five years, they might only get about 41–42 % of the original value back — worse than the average.

Specific examples:

- The luxury EV Jaguar I‑PACE led the pack with a ~72.2 % value drop over five years. (Motor Illustrated)

- Meanwhile, dependable ICE vehicles (like trucks and some SUVs) are holding up much better.

In the Canadian context, a study by Vincentric, LLC found that depreciation remains the largest cost factor for EVs, representing ~47 % of the total cost of ownership for EVs versus ~36 % for comparable ICE vehicles. (vincentric.com)

While many EVs still beat ICE vehicles on total cost of ownership (due to fuel & maintenance savings), the higher upfront cost and sharper depreciation are key risk factors. (vincentric.com)

This trend has major implications for auto appraisers, insurers, fleet buyers, and individual consumers alike.

2. Why Are EVs Losing Value More Rapidly?

Several overlapping reasons contribute to this pattern — many of which will matter directly in your appraisal work in Alberta.

A. Rapid Technological & Market Evolution

- Battery technology, range improvements, charging infrastructure: EV models become outdated faster than ICE models. Older EVs with shorter range or slower charging can become less desirable.

- New models are entering the market (often with bigger batteries or faster charging) at lower cost, which pulls down used EV prices.

- For example: one article observed “massive price swings, sparse inventory” in the Canadian used EV market. (Yahoo Autos)

B. Uncertainty About Battery Life & Replacement Costs

- Buyers of used EVs often worry about how much battery degradation has occurred, potential replacement costs, warranty status, and who will service them (especially older/rarer models).

- From Reddit discussions: “Battery degradation fears (justified or not) and cost to repair/replace the battery drive used EV prices almost entirely.” (Reddit)

This mindset dampens resale demand and thus value retention.

C. Incentives, Pricing & Residual Value Pressures

- Many new EVs have benefited from government subsidies, tax credits, and other incentives (Canada’s $5,000 federal rebate, for example). (vincentric.com)

- When new-EV transaction pricing drops (due to incentives, competition, scale), used EVs – purchased at higher previous pricing – can suddenly look like overpriced assets.

- In the Vincentric Canada study, only ~35 % of EVs had better depreciation than their ICE alternatives; the rest had higher depreciation costs. (vincentric.com)

D. Market Hesitation & Infrastructure Constraints

- Charging infrastructure remains uneven in many regions (particularly for multi‐unit dwellings or rural areas).

- In Alberta and Canada more broadly, range anxiety, cold-weather performance, and charging availability still factor into buyer perceptions.

- These perceptions translate into lower demand and thus lower residuals.

E. Business & Fleet Signals

- Corporate/fleet activity is also influencing perception. For example, Hertz Corporation dumped 20,000 EVs in one go citing high costs and resale issues. (Business Insider)

- News that major OEMs are delaying EV investments (such as Honda Canada postponing a $15 billion Canada EV plant) further raises caution in the market. (Reuters)

All of these combine to create stronger downward pressure on used EV values.

3. Local/Alberta Context: What Appraisers & Insurers Should Watch

Since you operate in Calgary/Alberta, here are specific implications:

- Cold-weather performance matters: Battery capacity reduces in cold climates; range/performance may drop. Older EVs may suffer more. That influences how buyers and therefore market value perceive them.

- Charging infrastructure in condos/urban vs rural: In urban Calgary the charging story is improving, but in rural or multi-unit housing the availability may still be a concern. This risk may reduce buyer pool, dragging residuals.

- Incentives/tax credits: The Canadian federal rebate ($5,000) helps new-EV purchase cost and thus indirectly supports residuals for newer models. But models that didn’t qualify or purchased before incentives may fare worse.

- Fleet vehicle transitions: Rental fleets selling off EVs flood the used-market supply, reducing resale value.

- Insurance/appraisal risk: For older EVs (say 5+ years old), battery replacement costs, software obsolescence, manufacturer support, and parts availability may increase risk. In appraisals you may need to factor in a “EV depreciation discount” or additional residual risk.

- Comparisons to ICE vehicles: In your role appraising vehicles, you might increasingly see used EVs trading at much larger discounts than comparable ICE vehicles — something to flag to clients, insurers, and claim departments.

4. Strategic Take-aways & Recommendations

Here are actionable insights you can apply in your appraisal / insurance role:

- Adjust residual value expectations for EVs

- Don’t assume EVs will hold value like similar ICE vehicles; build in larger depreciation factors (e.g., 55-60 % drop over 5 years) as a ball-park.

- When appraising a used EV, ask: what battery warranty remains? What has been the charging/usage history? How’s range compared to today’s benchmark?

- Separate battery / software condition risk

- Consider whether the EV’s battery has been under warranty or replaced — this is a major value factor.

- Consider software support: some older EV platforms may no longer receive updates, which could impact safety/support/perceived value.

- Check local market supply/demand dynamics

- Monitor local used-EV listings in Calgary/Alberta: high supply or discounting in certain models may drive down residuals.

- For fleets or commercial uses, note that heavy EV usage (high km) may accelerate battery degradation — factor that into risk and value.

- Communicate to clients/insureds

- When clients ask about EVs in loss-settlement or total-loss insurance scenarios, educate them that expected resale value may be lower, so settlement values may need adjustment.

- For prospective buyers (or adjusters), clarify upfront that while fuel/maintenance savings are strong, depreciation is still a weak point.

- Monitor policy/incentive changes

- Government policies (rebates, mandates, tariffs) shift and have outsized impact on EV valuations. For example, Canada recently delayed its EV sales mandate citing economic/tariff pressure. (AP News)

- Trade/tariff developments (especially in Alberta’s energy sector) may indirectly influence OEM costs/pricing and thus used-EV residuals.

5. Final Thoughts: EVs Are Not A Safe Value Retention Bet — Yet

To sum up: EVs hold real promise—lower fuel, fewer moving parts, environmental appeal—but when it comes to resale value, the market is showing caution.

If you’re in the business of valuing vehicles (as you are), you’ll want to treat used EVs as a separate class with distinct risks:

- Rapid tech obsolescence → faster depreciation

- Battery/charging risks that don’t apply in the same magnitude to ICE cars

- Government incentive swings that distort new-car pricing and ripple into used market

- Local infrastructure/market dynamics (especially in Alberta) that may suppress used-EV demand

Over time, as EVs mature, battery tech stabilizes, charging becomes ubiquitous, and secondary markets deepen, the depreciation gap may narrow. But today, undervaluation risk is real.